Table of Content

This energy tax credit covers 30% of the cost of an energy-efficient appliance or product for your home. This credit is only available for purchases made in 2017. They have over 70 categories of products to choose from. U.S. Representative Earl Blumenauer (D-OR) and other lawmakers introduced legislation in April 2021, to support first-time homebuyers with a refundable tax credit of up to $15,000. There are numerous incentives and grants available to first-time buyers in various states.

First of all, you can always withdraw your contributions to a Roth IRA tax-free (and usually penalty-free) at any time for any purpose. That means as much as 40% or more of the $10,000 could go to federal and state tax collectors rather than toward a down payment. So you should tap your IRA for a down payment only if it is absolutely necessary. To qualify, the money must be used to buy or build a first home within 120 days of the time it's withdrawn.

Stamp Duty Land Tax: relief for first time buyers

The child is a first-time homebuyer, but the parent isn’t. This means that only the child can claim the tax refund, and the refund will be for 50% of their eligible amount. When buying a home, many people overlook the significant cost of land transfer tax. When you acquire a property , you must pay a tax to the government after the transaction closes. The amount paid depends on the value of your property.

You can deduct PMI payments if your adjusted gross income is less than $100,000 if you’re married or $50,000 if you’re single. Persons with disabilities are also eligible for the Home Buyer’s Tax Credit, even if they’re not first time home buyers depending on a few conditions. To be eligible, the persons with disabilities must purchase a home for the purpose of living somewhere that is more accessible or better suits their needs.

State-Run Programs

A financial expert can help you plan your home purchase and other financial goals. Under the Tax Cuts and Jobs Act of 2017 , you can deduct any interest you paid on your mortgage, as long as you borrowed $750,000 or less. This includes mortgage interest you paid as part of closing costs.

Text for the bill saysthat first-time homebuyers of a principal residence in the U.S. could claim a tax credit equal to 10% of the purchase price of the tax residence during that tax year. Depending on your tax-filing status, the bill limits the credit to $7,500 for married individuals filing separately. In its first iteration, the first-time homebuyer tax credit granted first-time homebuyers a tax credit of up to 10% of the home’s purchase price.

First time home buyer tax- breaks for your 2017 income taxes.

If you reimbursed the seller for their prepaid real estate taxes, you can take those as itemized deductions as well. The FHAno closing cost loanallows all of your closing cost to be rolled into your loan including your appraisal fee, hazard insurance premium and even your escrow account. This credit is available every year that you have the loan, and for every year that you live in the house you purchased with the certificate. In addition, any credit will be automatically subtracted from the income tax you owe.

FHA now requires a minimum credit score of 500 to be eligible for a FHA loan. Get live help from tax experts, plus a final review before you file — all free. You will need to qualify for the Mortgage Credit Certificate program before purchasing your home to claim this credit. To claim this credit, you must apply to your local or state government to obtain the certificate. Could reduce the amount of tax you have to pay when you sell your own home.

And once the account has been open for at least five years, you can also withdraw up to $10,000 of earnings for a qualifying first home purchase without any tax or penalty. For example, if you paid two points (2%) on a $300,000 mortgage—$6,000—you can deduct the points as long as you put at least $6,000 of your own cash into the deal. And believe it or not, you get to deduct the points even if you convinced the seller to pay them for you as part of the deal. The deductible amount should be shown on your 1098 form. Does not require collection accounts to be paid off as a condition of mortgage approval.

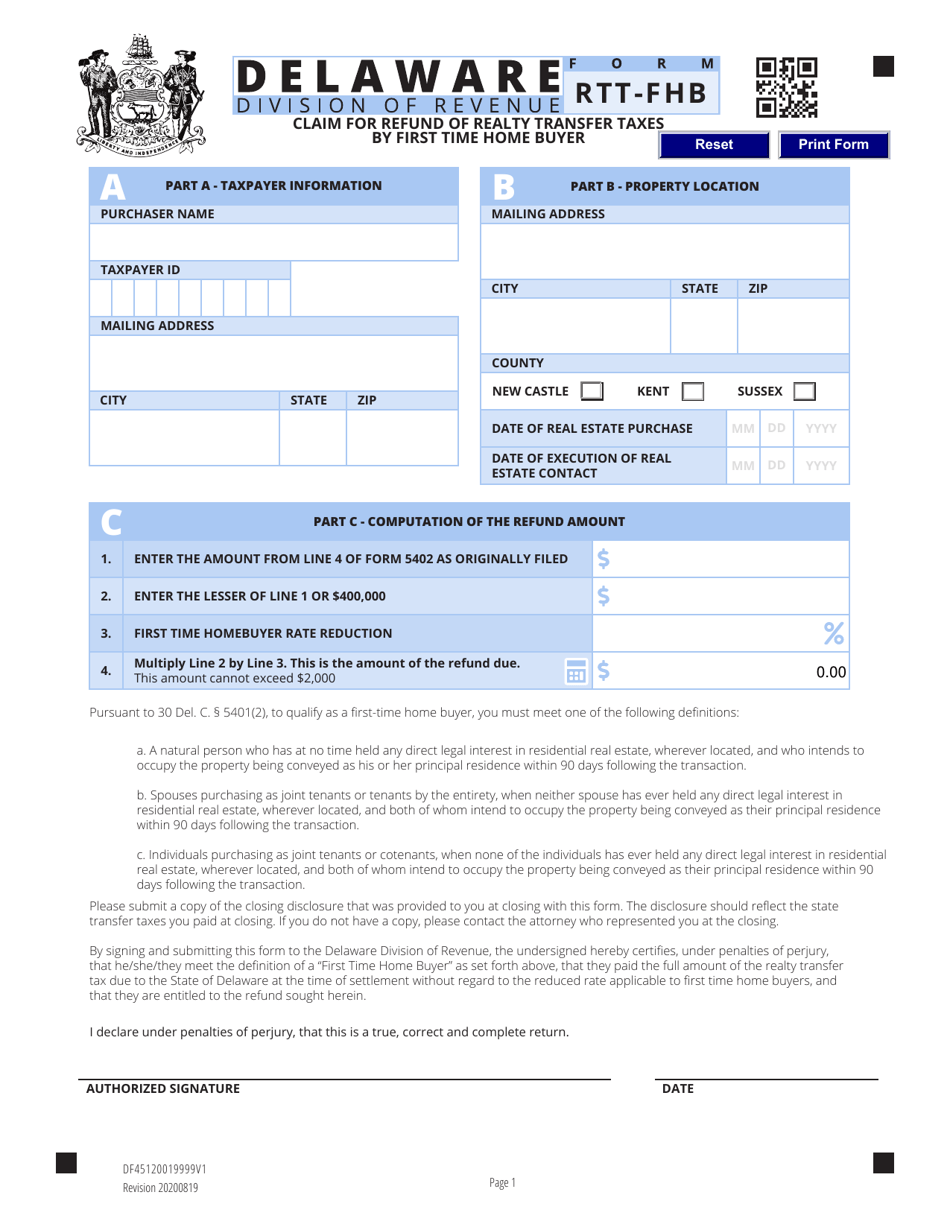

We’d be lying if we didn’t acknowledge that buying a home can be a significant investment both up front and over time. If you’re considering taking the financial plunge into homeownership, here are the costs you should expect going into the process. To claim the deduction, you must get a mortgage credit certificate from an authorized state or local government agency. The credit is limited to up to $2,000 and qualification criteria varies by state. The mortgage interest deduction is available on qualifying mortgage loans used to buy, build or improve your home. The deduction can be taken as standard or itemized, whichever is higher and therefore more helpful for those filing.

To calculate how much land transfer tax you will need to pay, use the Ontario land transfer tax calculator at the top of this page. Finally, the IRS allows first-time home buyers to withdraw up to $10,000 from their traditional individual retirement accounts to help buy or build a home. You can use the money without paying the 10% early withdrawal fee, but you'll still have to pay normal income tax on the withdrawal.

If you pull from your IRA to cover your down payment and other purchasing costs, first time home buyers do not have to pay the $10 penalty fee for early withdrawals. If enacted into law, qualifying first-time home purchasers will get their tax credit immediately, with no action required other than the submission of a tax form. Furthermore, if a homeowner’s tax payment is less than $15,000, the excess amount will be paid by direct deposit. Property taxes are also a great avenue when it comes to deductions.

Payroll Payroll services and support to keep you compliant. Whether you’re looking for a midcentury home or an old Victorian home, American Home Shield has everything you need to know about buying an old house. Typically, you do have to use the home as your primary residence in order to qualify for the exemption. You must occupy the property as your principal residence.

If you bought your home on or before December 15, 2017, you’re grandfathered in under the old limit of $1 million, so you can deduct loan interest on mortgages up to that amount. You can snag this homeowners tax credit every year you’re paying on your mortgage and for subsequent home purchases as long as your loan amount is below the threshold. You can also deduct the interest you paid on a home equity loan up to $100,000, if you use that money to improve your home. Are you an interested party looking to take advantage of the tax credits and deductions for new homeowners? Merely Lucia will guide you through what you need to know about being a first-time home buyer and how to claim those tax deductions to your advantage. The Tax Cuts and Jobs Act of 2017 introduced a number of changes to the tax code, including new tax credits and deductions for first-time home buyers.

Where the first time buyer is being granted a new lease users will need to overwrite the tax due figure on the return. Users can use the calculator on GOV.UK to calculate how much SDLT is due. This is expected to involve negligible additional work. Individual states may have their own credits available for first-time home buyers, but down payment assistance is far more common. Whether you live in California, New York or somewhere in between, a good place to start your search is HUD’s local home buying page.

If you’re already a homeowner, this isn’t news to you. However, if you’re in the market for your first home, we've got valuable information for you. A partial exclusion means you get part of the $250,000/$500,000 exclusion.

No comments:

Post a Comment